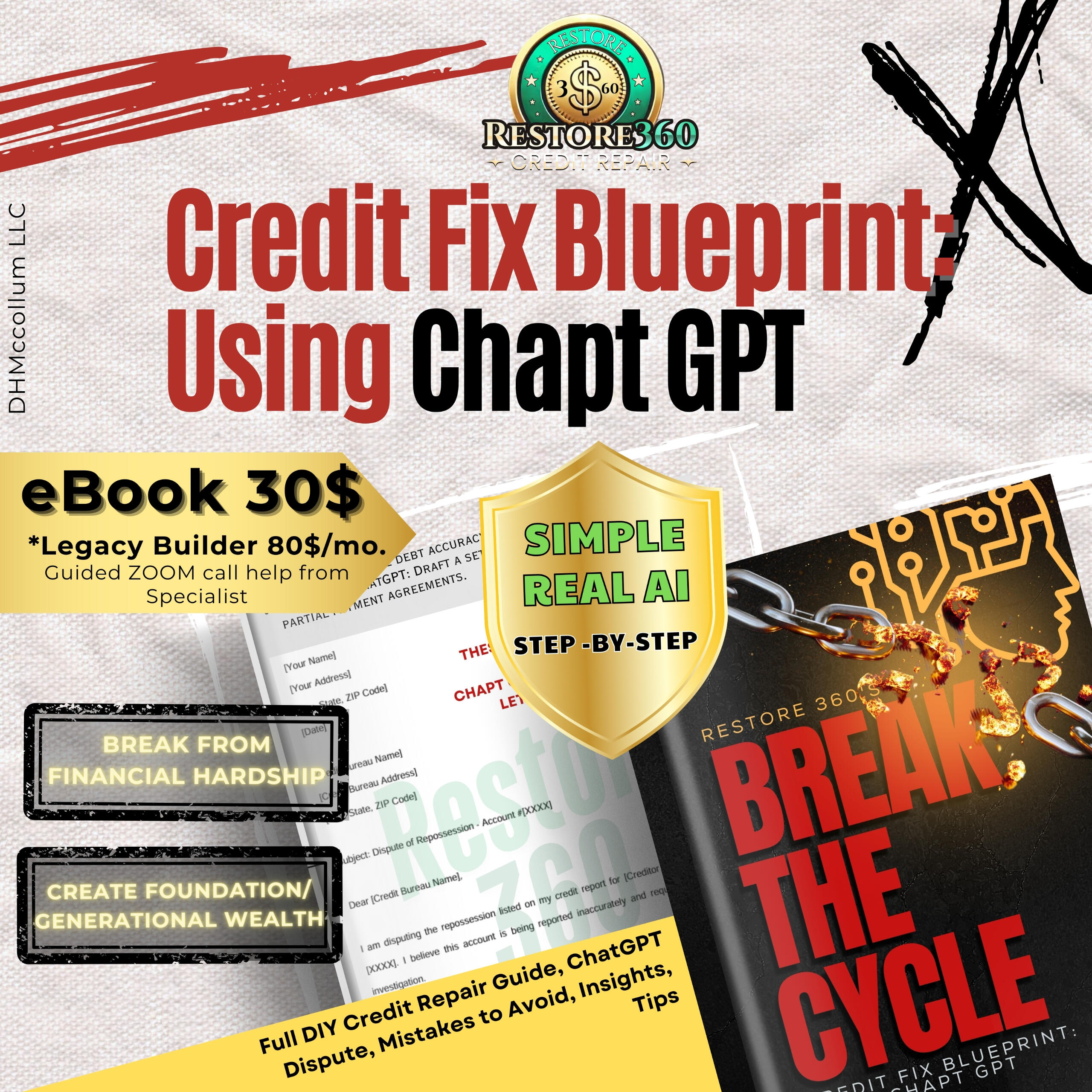

🚨BREAK THE CYCLE🚨🏡 Want to build a strong foundation to pass on wealth, not debt?

It's time to take control of your future!💡 What You’ll Learn:

✔️ How to erase financial mistakes and rebuild credit the right way

✔️ How to dispute the 5 most common negative items affecting your credit

✔️ Use ChatGPT to generate powerful dispute letters

✔️ Avoid credit traps that keep families in cycles of debt

✔️ Create a financial foundation that you can pass down to the next generation

Break free from past mistakes, take control, and create generational wealth.

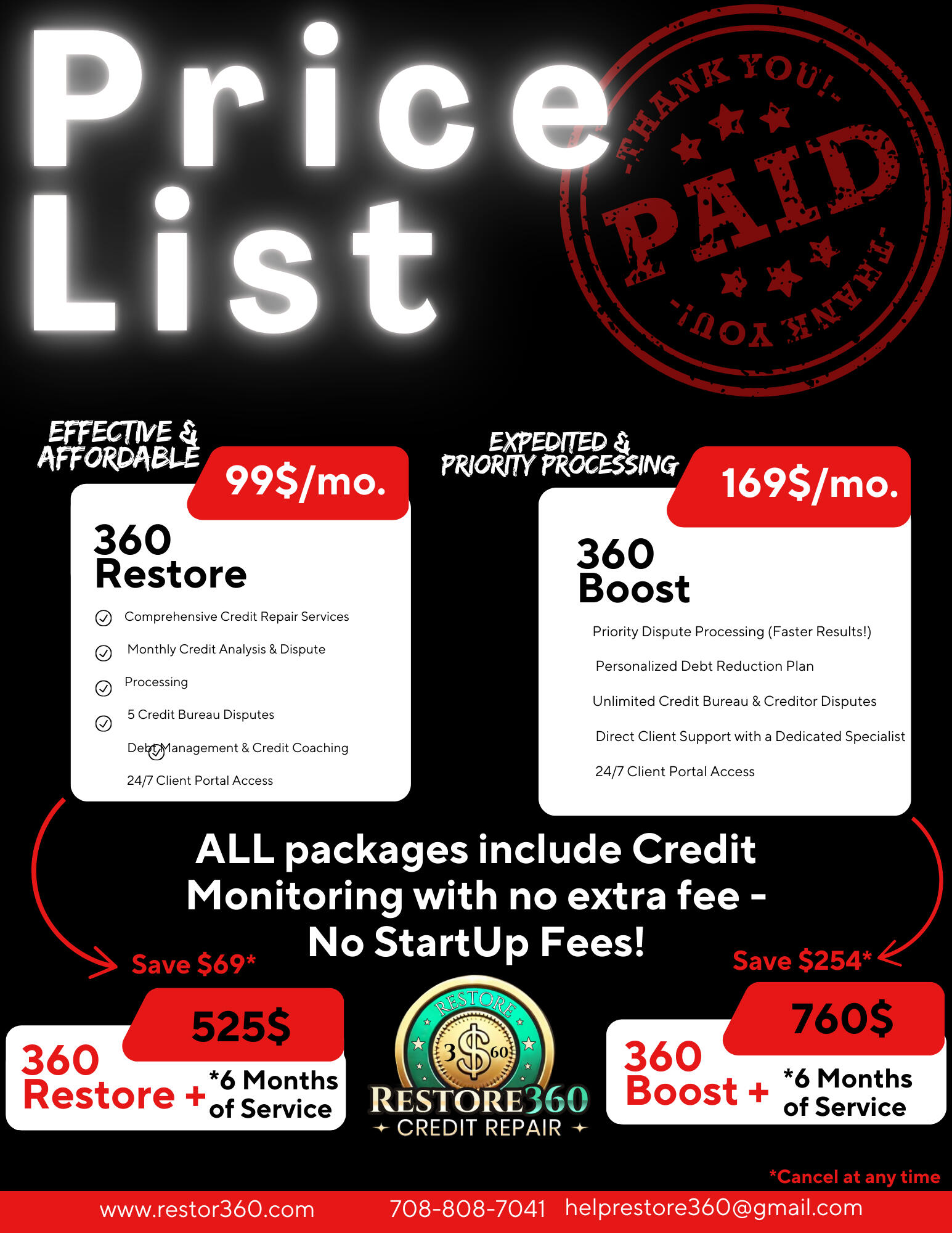

PLANS

Stay connected with us on social media for the latest updates, financial literacy resources, credit tips, exclusive giveaways, special promotions, and more!

Our Story

Restore360 was founded with one mission: to help individuals rebuild their financial futures after setbacks caused by life’s unpredictability, like the pandemic and economic disruptions. We understand that your credit score is more than just a number—it’s your pathway to achieving dreams and securing opportunities. We believe in second chances, and we are committed to providing a comprehensive, full-circle approach to credit restoration that empowers you to reclaim control over your financial life.

Damila Mccollum

Founder. Lead Specialist. Mom.

Allow me to introduce myself, I’m a proud mother of two amazing little girls. My journey has been all about learning, growing, and building a better future—first for myself, and now, I want to help others do the same.I started from the ground up in the beauty industry, selling lashes, and then I grew into owning my own successful boutique. I didn’t stop there—I ventured into the rental industry, launching my own car rental business. Now, I’m climbing the corporate ladder, all while dedicating my time to helping others achieve financial success.Through my personal experiences, I’ve learned the ins and outs of financial literacy, and it’s given me the opportunity to not just build for myself but to truly thrive. I believe everyone deserves the chance to have a good life, and no one should be excluded from access to affordable tools that help them succeed.I’d love to help RESTORE your faith in your finances and guide you to a brighter, more secure future. Let’s work together to make that happen!

How This Works

Initial Credit Report Audit: We begin by reviewing your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify any inaccurate, outdated, or potentially negative items that could be harming your credit score.

Comprehensive Dispute Process: Any items that appear to be incorrect or unverifiable are disputed with the credit bureaus. We focus on challenging those items and requesting a thorough investigation into their validity.

Item Investigation: Once a dispute is initiated, the credit bureaus must investigate the disputed items within 30 days. During this time, the bureau will reach out to the creditors to verify the information. If the creditor cannot verify it, the item may be removed from your credit report.

Regular Progress Updates: Throughout the process, we keep you informed of the status of your disputes and any changes to your credit reports. You'll receive regular updates so you're always in the loop.

Credit Report Monitoring: As your disputes are resolved, we continuously monitor your credit reports for any changes, ensuring that only accurate and valid information remains on your report.

Post-Resolution Strategy: After successful disputes, we offer guidance on how to maintain and improve your credit standing, including advice on managing credit utilization, paying bills on time, and other key strategies to boost your score.

Ongoing Support: If any new issues arise, we can re-initiate disputes or provide ongoing credit guidance to help you continue improving your credit health.

This process is designed to help you clean up your credit report, fix inaccuracies, and ultimately boost your credit score over time.

© 2025 DHMcCollum LLC. All Rights Reserved.